In recent years, many cities have been experiencing a surge in investments and economic activity. However, many low-income people, especially people of color, who have lived in these cities through long periods of previous decline face displacement as rents rise and wages stagnate. It is a similar dilemma for locally owned small businesses which are also being priced out of the neighborhoods as lease rates skyrocket. Such displacement pressures destabilize families, neighborhoods, and entire cities.[1]

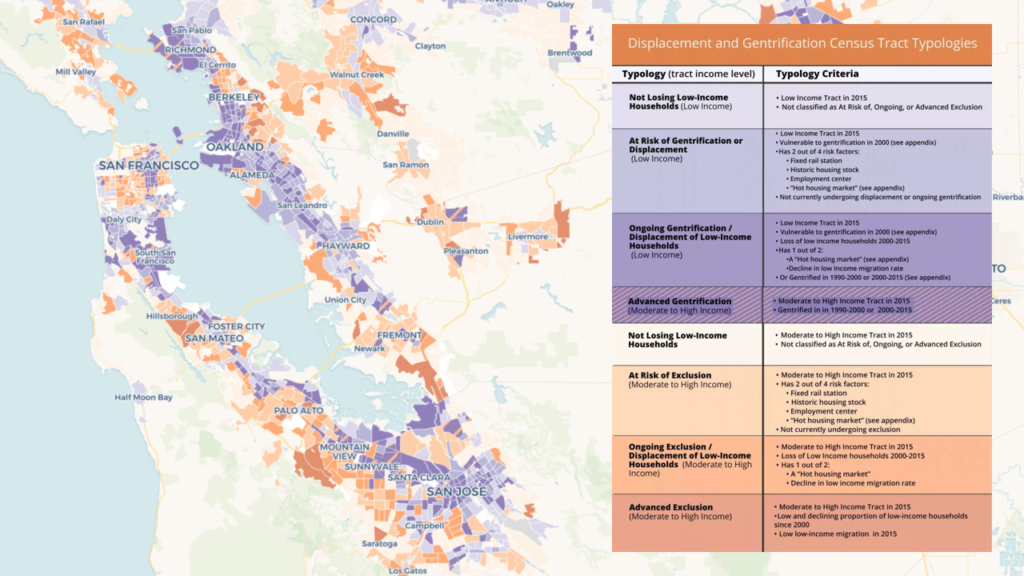

This context is fostering the new trend of anti-economic development, which was birthed out of harsh experiences that too much economic development can actually be bad for the local residents in the areas where redevelopment and investment occur. This displacement economic development creates an economic vitality in which the people born, raised, and who sustained these cities through recessions and economic downturns cannot benefit. They live (or lived) in neighborhoods which are gentrifying into hip neighborhoods where they can no longer afford to live.

Displacement economic development benefits resilient, smart, wealthy, property-owning, future residents. It hurts the precarious poor, renting, disadvantaged, long-time residents.

Marginalized local residents are experiencing economic development in high-economic growth geographies that excludes them from a future they can afford. They don’t want that future and are ready to fight it.

Traditional Theories of Job Multiplier Benefits are Failing

The New Geography of Jobs points out “Apple, for example. It employs 12,000 workers in Cupertino. Through the multiplier effect, however, the company generates more than 60,000 additional service jobs in the entire metropolitan area, of which 36,000 are unskilled and 24,000 are skilled. Incredibly, this means that the main effect of Apple on the region’s employment is on jobs outside of high tech.” Despite this, the impact to the unskilled and lower-paid workers are punitive when the economic investment results in those lower-skill/income people no longer being able to afford to live in the community with those new service and retail jobs, or they have to live so far away to commute to those jobs that the total length of commute results in a quality of life below what they had before.

Apple’s HQ is located in the City of Cupertino, where the median household income is over $175,000 and 74% make more than $100,000 per year. The median cost of a home in Cupertino in March 2019 was $2,160,500 and $1,209,700 in the metropolitan area. The median rental rate in Cupertino was $4,000 per month and $3,600 in the metro. It’s not just that unskilled and average skilled people can’t afford to live in Cupertino; they can’t even afford to live in the metropolitan region. Their lives are being disrupted due to gentrification and they are being forced out of housing in which they can no longer afford.[2]

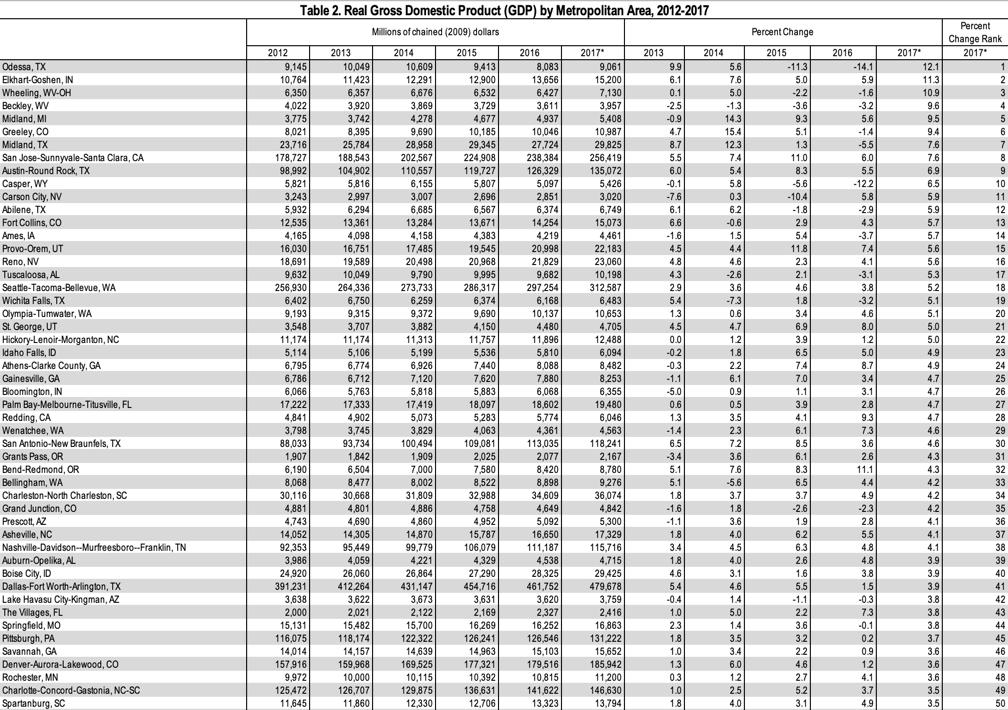

This type of displacement economic development isn’t a problem everywhere. It is currently mostly concentrated in the geographic areas experiencing rapid or sustained economic investment. (See chart at the end with top 50 GDP growth by metro area). Poorer regions may be so desperate for any economic development that they are eager to accept all projects. For these areas the related negative effects of business investment may be very small or, because their residents are already in such desperate circumstances, any opportunity may be initially seen as acceptable.

However, in the metros and states which are the economic engines of the United States, this is either a current crisis or a near-future predicament if growth continues.[3] Also, rising costs of living are not limited to just the biggest cities and metro areas. The Odessa, Texas metro had the highest US annual metro growth in GDP in 2018 at 12.1% and the highest annual rental rate increase of 21.8%. Yet the annual median household income increased less than 2% in Odessa in 2017. When rents rise 22% and incomes rise 2% displacement happens to local residents, including resulting homelessness.

Amazon HQ2 is an Early Sign of More Resistance to Come

The most high-profile corporate attraction project in decades was the location decision of the second Amazon headquarters office, better known as “Amazon HQ2.” It was promoted to bring 50,000 jobs at an average salary of $150,000 per employee. 238 cities and regions across North America mobilized significant resources to compete to win this mega-project. On November 13, 2018 Amazon announced it would split the project equally into the two locations of Crystal City, Virginia (in the Washington DC metro) and Queens, New York City.

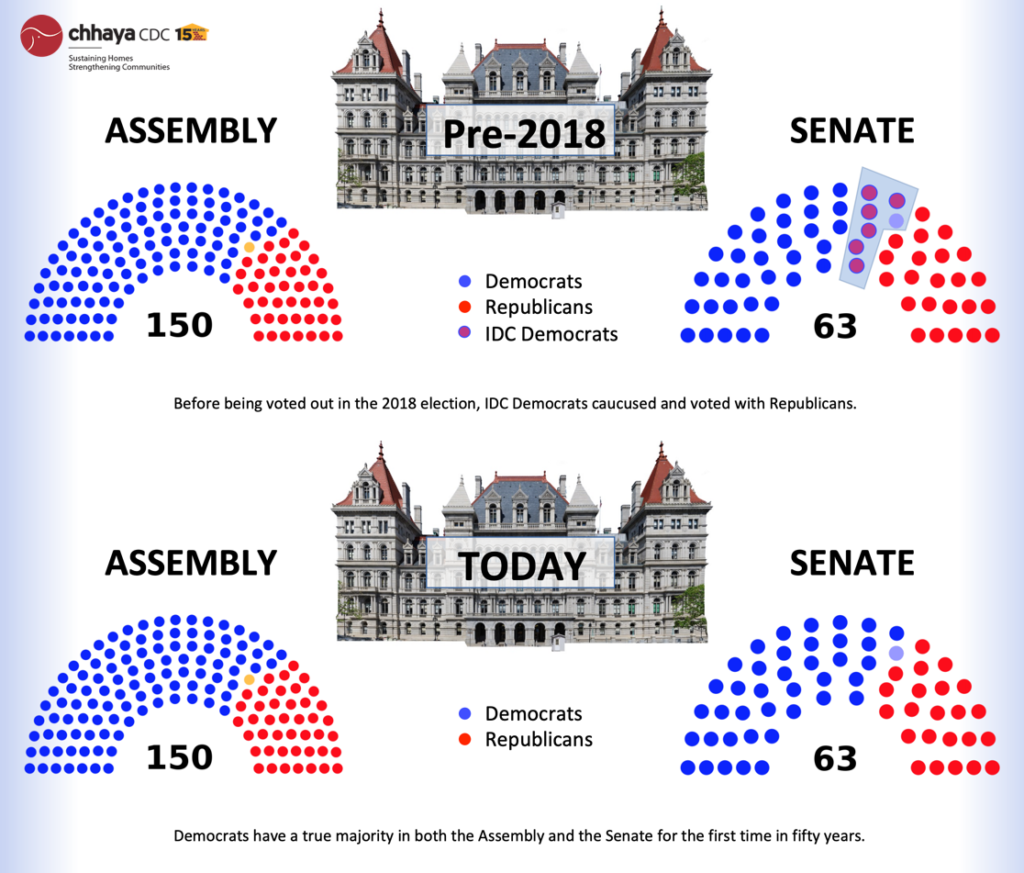

After the announcement that New York City had “won” the Amazon HQ2 project through a process in which “the deal was approved through a process that prevented city officials and residents from weighing in at all,” local residents, businesses, and eventually the elected officials in Queens decided it was not a win for them and they organized to kill the project. On February 14, 2019 Amazon announced they were cancelling the NYC headquarters.

For economic development professionals across North America who were following this project or were a finalist to win it (unless your city had protesters too), the decision of the selected community to actively make sure it didn’t ever come to Queens must have been confusing if not out-right unthinkable. However, to residents of Queens, it made obvious sense to fight it for a variety of reasons, including the increase in the cost of living (such as rents) that would occur to local residents and businesses from Amazon locating there, which would accelerate them being displaced from their own neighborhood.

The story of how community organizers led a grass-roots effort to stop the Amazon HQ2 campus from locating in Queens is documented in numerous news articles. Although the related issues are worth learning from, there are two which may be less known but are critical for economic developers to be aware:

- No-compromise ultimatums

- Economic development impacts for elected officials

Rima Begum, Community Organizer at Queens-based Chhaya CDC, was part of a collaboration that worked with residents, businesses, and other organizations to stop Amazon from opening in Queens. She explained a key element of their strategy was that opponents of the Amazon project took the position that there would be no compromise about the terms of Amazon coming and instead the only acceptable outcome was that Amazon would not be allowed to come at all.[4] The reason for this approach was thoughtfully considered and strategized by community members.[5] They understood that any decision that resulted in Amazon coming, even with mitigation and compromise, would simply delay the same ultimate outcome: over time, cost of living increases including rental rate rises for residents and businesses would result in the eventual displacement of current residents from the neighborhood. Gentrification from wealthier Amazon employees making an average of $150,000 per job and the newly supporting companies that want to be near Amazon would price them out.

Another powerful impact on Amazon’s decision to abandon the project was the community pressure placed on elected officials. As Amazon said in a statement, “A number of state and local politicians have made it clear that they oppose our presence and will not work with us to build the type of relationships that are required to go forward.”[6] The announcement of the selection of New York City happened immediately before the 2018 midterm election day. This could have theoretically provided political cover for elected officials as they wouldn’t be up for reelection for years. However, one of the other things that happened in that election was that the community organizers in the State of New York campaigned successfully to replace the more conservative Democratic Party officials with newly elected officials that promised support for affordable housing and anti-gentrification. Because of the grass-roots organizations’ success redefining the New York State Legislature their threat to replace elected officials that did not oppose Amazon moving to Queens in the next election was credible and motivating. The elected officials support of their constituents’ positions was key in Amazon abandoning their plans to come to New York City.[7]

This is also an example which brings attention to why support for external economic development that doesn’t directly help current residents and local businesses can be detrimental to elected officials.

Impacts of Traditional Economic Development

Policies that can hurt the poor, foster gentrification, and help the above-average are ingrained in the practice of economic development. As examples, some of the traditional goals and measurements of economic development success lead to displacement:

- Raise the area’s average salary: It is a common goal amongst Economic Development Organizations (EDOs) to raise average salaries as an indicator of increasing community wealth. Pursuing this goal requires the creation or attraction of higher paying jobs that are likely going to be filled either by economically/educationally above-average people in the community or from people outside the community. These are less likely to be jobs for the poorer members of the community. As average incomes increase, costs of living increases will likely follow. A more equitable measurement of economic development success which could replace this traditional goal would be an increase in the median income for every income quintile in the community.[8]

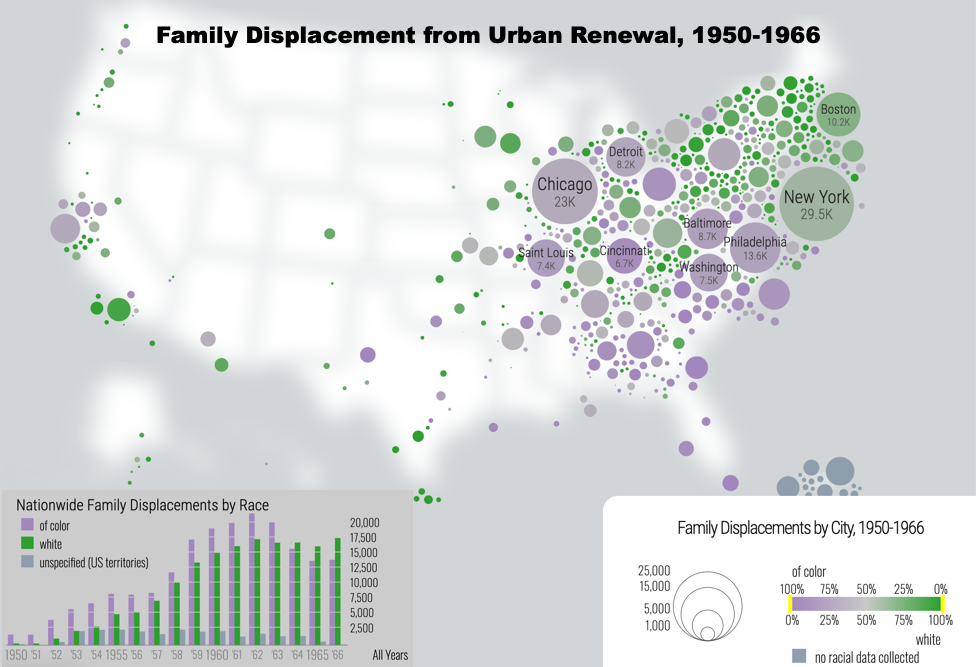

- Revitalize blighted neighborhoods and buildings: It is uncommon that even in extremely distressed neighborhoods that no one lives or works in them. Instead, the most marginal residents and businesses operate in these places because of the associated affordability. As areas improve, properties are remodeled, vacant land is developed, buildings are razed and new office buildings are erected. As a result, the businesses that used to be in buildings torn-down to make way for new buildings are displaced, residents’ rents go up or they are evicted,[9] and the social connections of neighbors are broken. Failed programs of the past including Urban Renewal were explicit policies of displacement of the poor and racial minorities. Current blight-removal has elements of the same end-results. A more equitable measurement of economic development success would include the economic benefit to the existing residents and businesses enabling them to continue to stay in the neighborhood post-revitalization.

These economic development initiatives are not necessarily bad in-and-of-themselves if they are combined with mitigating initiatives created in partnership with local residents for their shared benefit. But they are damaging when the people living in areas that need revitalization don’t get to benefit from the revitalization after it happens. To be equitable to the people whose presence in the place is what has kept the areas alive so far, they need to be able to be part of its future. To do this requires economic developers to make sure that local residents can own this future, either as property owners or through guarantees to be able to continue to live in the area indefinitely – and not just until the rents go so high that they can no longer afford them because otherwise this is simply a delay to their inevitable displacement.

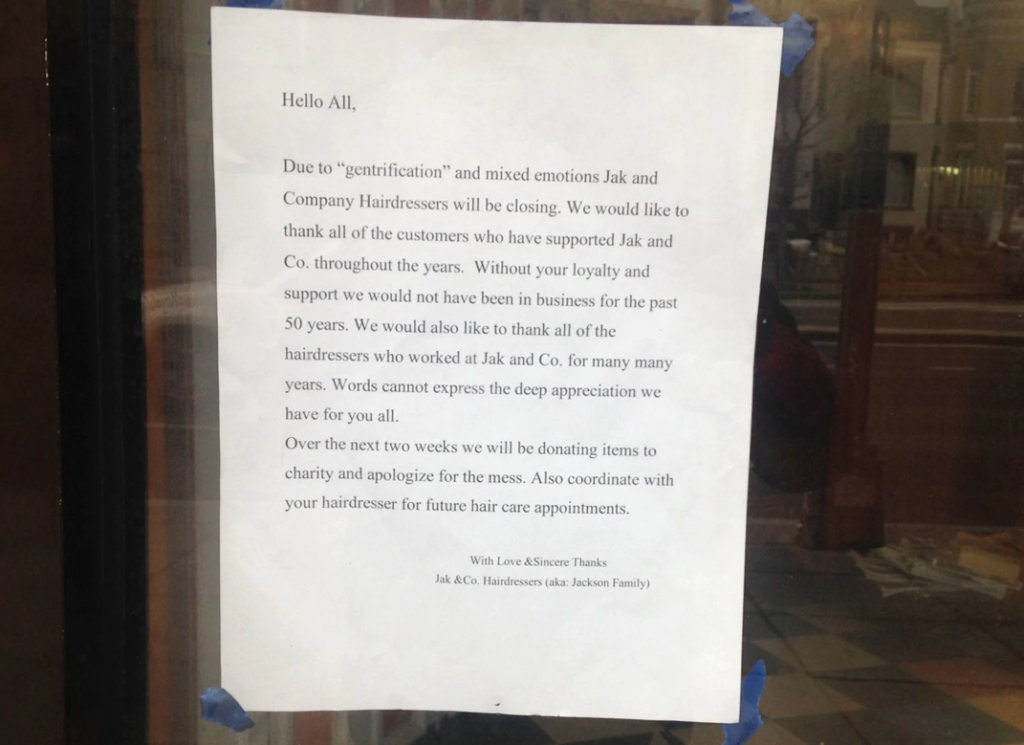

It’s not just the people who have lived in the area pre-gentrification that get displaced from the neighborhoods they have sustained for years or decades. It’s also the locally-owned small businesses. As property values increase, so do commercial rents. This can put these long-time local businesses owned by residents of the community out of business. In the gentrified neighborhoods and commercial corridors boutique businesses and national retailers come in after they are “safe” and can pay lease rates that exceed what existing small businesses can pay. Small businesses that sustained and created a foundation for future revitalization are punished for their commitment to being a foundation for revitalization of their neighborhood by being displaced from it when it becomes gentrified, even more so because public policy/financing for redevelopment has accelerated the rise in cost. Economic developers that see this as unacceptable have to plan for economic growth that is inclusive of the legacy businesses either by making sure there is a viable path for them to own properties or in which future developers are required to include commercial space for existing businesses which they can stay in indefinitely at guaranteed lease rates, and which will not go up dramatically in the future, as this would only delay their inevitable displacement.

The retention of existing residents and businesses may require public intervention to facilitate community benefit goals, but this type of practice is not new to economic developers. EDOs have a long history of providing significant subsidies in the form of infrastructure, tax breaks, grants, workforce training, and other financial incentives to new businesses coming into a community even in opposition to criticism of this practice. This simply provides it to the people and small businesses that have sustained the communities all along.

New Collaborators and Priorities

For economic developers to effectively support local and inclusive economic development requires an expansion of collaborators and a reorientation of geographic focus.[10]

Innovative concepts, programs, and policies for economic development are coming from community development organizations. These community developers are logical partners for economic developers because they may already be working in the same communities and because, by necessity to be effective, they are forced to think holistically to bring comprehensive solutions to communities that span multiple areas of expertise including economic development, housing, social work, labor, banking, and law. National community development organizations such as NACEDA, NALCAB, National CAPACD, and the National Urban Leaguecan help direct economic developers to local professionals and the types of services being offered.

There are so many people working hard to make the successful more successful and the rich even richer. There is no limit to the support and financial resources that will be made available to the people and businesses that are already winners. Yet there are too few resources for people with unstable futures potentially made more precarious by economic development created in your community. These people are part of economic developers’ constituency.

Everyone Supports Local Economic Development

Two popular economic development initiatives are business attraction and talent attraction [11]. Both of these strategies rely on bringing in outside resources to create economic growth. Neither focuses on nurturing and growing local assets, such as the people already living in the community. These types of external initiatives will face increased resistance from local residents when their livelihoods are threatened by these policies.

People still want economic development, but they want local economic development. Even the community organizations that are most vocally against externally-focused economic development are supportive of economic development that helps local residents, small businesses, and lower-income members of the community.

To foster local economic development requires economic developers to strengthen existing programs to help local residents and businesses as well as create new programs to achieve the goal of retaining residents and businesses in the community for the long term.

The following 10 economic development programs support local residents/businesses and can be used to mitigate the likelihood of displacement caused by rapid economic investment, gentrification, and redevelopment.

1. Business Retention and Expansion

This is the most traditional of the local business assistance economic development programs, although it is modernizing to keep up with the times. It still has a core focus on keeping local businesses in town and helping them expand their businesses. BRE as a practice is growing in relevance. However, one of its implementation challenges is the limit to how many businesses can actually be assisted due to staff time and funding constraints.

2. Workforce Training

Training and retraining of workers is a larger and higher-funded profession than economic development. This is even more of a reason to partner with service providers, which come from diverse places including vocational training, community colleges, universities, libraries, and the growing field of online learning. Investing in the knowledge and skills of local residents and business people makes them more resilient to changes in the economy as well as prepares them for new jobs that may be coming as a result of your economic development initiatives. Online learning represents a means to assist broad numbers of your residents if it can be made available affordably or for free.

3. Online Small Business Assistance

The internet has meaningfully expanded the assistance economic developers can provide local businesses. Unlike manual or staff-intensive programs that can take up a lot of staff time, online small business assistance can serve entrepreneurs 24-hours a day with services that can help all businesses. Advances in big data and computing enable EDOs to provide industry-specific and hyper-local market research and business intelligence so entrepreneurs can make smarter decisions based on data.https://www.linkedin.com/embeds/publishingEmbed.html?articleId=8253979197486362881

4. Libraries

Local libraries are much more than simply repositories of printed books because librarians are adapting to make themselves community spaces for local businesses. This includes providing physical space for business incubators, hot desks, after-work small business seminars, online data and research subscriptions, industry-specific publications, and business meeting space. Economic developers can direct local residents and businesses to new services that libraries are providing.

5. Small Business Property Ownership

When neighborhoods gentrify, especially through rapid economic investment caused by economic development programs like Opportunity Zones or the attraction of a large company, locally-owned small businesses can get priced out as rents go up. Like doctors, economic developers should first “do no harm” to their current constituency of businesses and ensure that future neighborhood success is shared by those residing in them now. As Phaedra Hise explains writing for American Express, “Ultimately, the only way to win this battle over the long term is to be both the small-business owner and the landlord by owning your own building.” Ownership of real estate that the small business can own for the future can be accomplished different ways but it is vital to prevent displacement. Low/no-interest financing, revolving loans, grants and other financial instruments facilitated or managed by local EDOs and CDFIs can enable this, as can requirements that new real estate developers set aside portions of the new development to be sold at a rate which is viable for small businesses currently located in the area (or for those which will be displaced as the owner of their current building sells it to a real estate developer that tears it down for a new building).

Economic developers commonly offer financial rewards for businesses that create new jobs through new real estate development and the attraction of businesses. It’s not uncommon that this can equal $50,000 per job over time. What if there was also a job displacement incentive in which businesses had to pay $50,000 per job displaced? That would be a strong financial incentive for developers to keep local businesses and jobs in the neighborhood.[12]

6. Incubators

Economic developers made business incubators a program of focus before their attention turned to the more glamorous program of “accelerators” for high-growth businesses. But a return to incubators is valuable to enhance the start and sustenance of businesses providing core community products and services if implemented correctly. In addition, incubators can evolve to focus on the most under-represented and marginalized small business owners to provide specific services to women, immigrants, people of color, veterans, and other at-risk groups. The economic benefit of bringing these groups into parity with typical business owners can be transformative and impactful locally and nationally.[13] Organizations providing these services, which are already in operation, can be a model for other communities to replicate.

7. Residential ownership

There is perhaps no more effective way to ensure that local residents benefit from the long-term economic growth of neighborhood revitalization and prevent displacement from gentrification than enabling residents to own their own home. Housing has typically been associated with, but tangential to, the work of economic development. However, with the fast rate of economic investment resulting in economic displacement for current residents it needs to be a policy at the center of local economic development.

8. Small Business Financing

SBA loans are a common national program to support small businesses guaranteed by the federal government. The largest SBA 7(a) lenders by total approval amount are Live Oak Banking Company, Wells Fargo Bank, The Huntington National Bank, Newtek Small Business Finance, Byline Bank, Celtic Bank Corporation, JPMorgan Chase Bank, U.S. Bank, First Home Bank and KeyBank. The largest SBA 7(a) lenders by total loans approved are The Huntington National Bank, Wells Fargo Bank, TD Bank, U.S. Bank, JPMorgan Chase Bank, Independence Bank, First Home Bank, Manufacturers and Traders Trust Company, Live Oak Banking Company, and Newtek Small Business Finance.

Community Development Financial Institutions (CDFIs) are mission-driven to focus on distressed communities in the USA. They offer tailored resources and innovative programs that invest federal dollars alongside private sector capital taking a market-based approach to supporting economically disadvantaged communities that lack access to capital.

In 2015, JPMorgan Chase launched the Entrepreneurs of Color Fund to expand access to capital and business training, networking and services to underserved minority entrepreneurs, which Chase sees as a high-growth opportunity. Jamie Dimon, Chairman and CEO of JPMorgan Chase said, “The Entrepreneurs of Color Fund has unlocked capital and created hundreds of jobs in Detroit, and now we’re excited that Chicago small businesses will have the same chance to grow and succeed.” The program has expanded to other US cities. Since starting the program only one business has defaulted, which is worth noting because many of the borrowers had trouble obtaining traditional funding.

Women are also an underserved and growing opportunity for financial investments. Financial investments in women-owned companies result in higher rates of return than male-owned businesses according to Harvard Business Review.

9. Entrepreneurial Training

As jobs that sustain the financial needs of lower-income families diminish, business ownership is growing to be a more relevant asset-building strategy. In addition, the median net worth of entrepreneurs is 2.5 times higher than non-business owners. However, low-income people face many barriers to entrepreneurship including access to capital and culturally appropriate business counseling.[14] Economic developers that want to strategically target high impact opportunities can focus on marginalized entrepreneurs to create maximum growth. For example, according to Global Policy Solutions, if people of color owned businesses at the same rates as white entrepreneurs, it would result in 9 million more jobs and $300 billion in worker income. https://www.linkedin.com/embeds/publishingEmbed.html?articleId=7779977127891430084

Another high-growth population is women entrepreneurs. Since 2007, the number of women-owned businesses has increased by 58 percent, which is better than businesses overall, which increased by only 12 percent.[15] Additionally, the success of companies run by women is evident in large, publicly traded companies. Research from Nordea Bank shows that companies with a female CEO or chairman more than doubled the performance of the MSCI World Index.

Immigrants and the children of immigrants are also a powerful source of economic growth. Seven of the ten most valuable US companies were founded by immigrants and children of immigrants, as were other modern companies such as Google, SpaceX, ebay, PayPal, wework, Yahoo, WhatsApp, and Comcast. American immigrants or their children founded nearly half of all Fortune 500 companies and immigrants have founded 51% of U.S. billion-dollar startups. Although these are high profile examples of entrepreneurial immigrants, in general, immigrants are twice as likely to start a business as those born in the US.[16] Providing entrepreneurs with the training and finance they need with services that are tailored to their unique situations can help potential entrepreneurs already living in your community.

10. Economic Gardening

This form of business assistance accelerates the growth of local businesses which economic developers identify to be potential “gazelle” winners that can grow quickly. It has defined itself as the opposite and an alternative to business attraction because it focuses exclusively on local businesses. A recognized weaknesses of Economic Gardening is that it only serves a small number of businesses which are already showing success and, if the services are provided to anything other than innovation companies, it has similar effects of business attraction by simply stealing market share from other geographic areas.

The New Orleans Effect

Although anti-economic development movements are flaring up in some US localities like New York City and more conflict may emerge in cities like yours, the recent history of New Orleans brings together many of the challenges and opportunities that face economic developers committed to serving the residents and small businesses that currently reside in their communities.

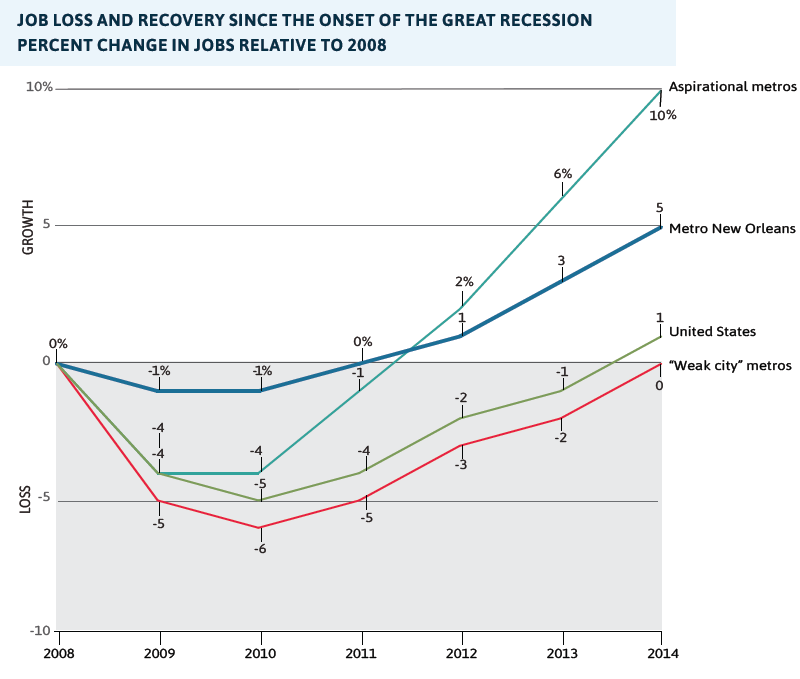

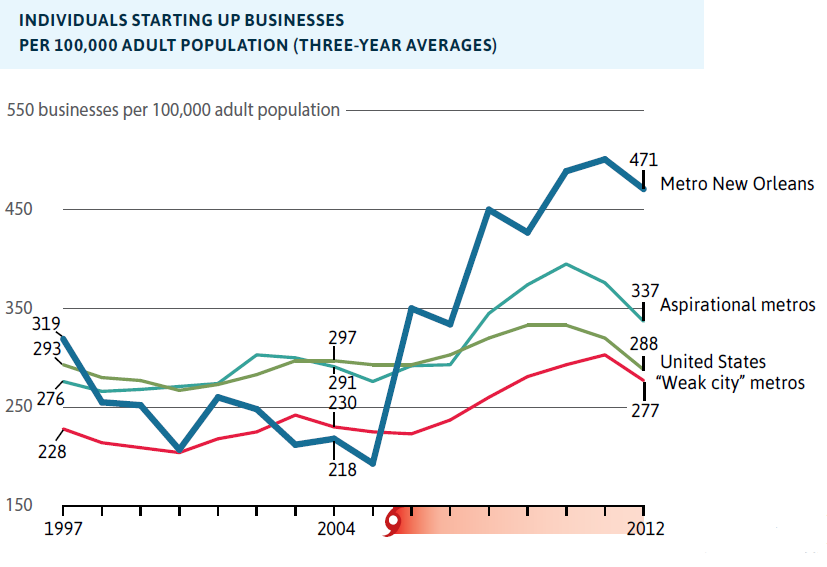

At an IEDC conference my friend Roderick Miller, while he was President and CEO of the New Orleans Business Alliance, shared what happened post-Katrina and how economic development played out in New Orleans. Immediately following Hurricane Katrina, the city experienced a colossal economic downturn and the displacement of a sizable portion of the city’s population, especially its African American and low-income population. However, the City emerged, based on aggregate economic indicators, as an economic development growth powerhouse. Job creation outpaced national and peer metros. New business startup rates exceeded US averages by 64%.

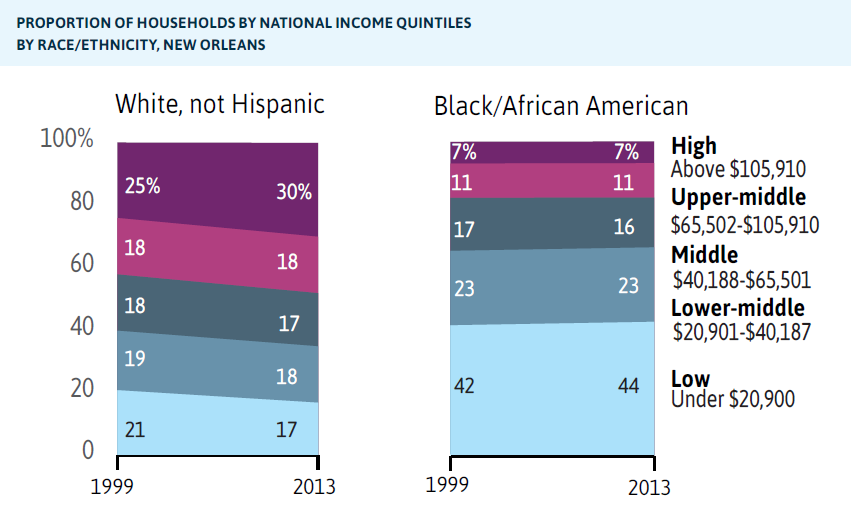

According to Miller, what optimistic economic indicators did not reveal is who the beneficiaries were from this rapid economic investment. New companies arrived partially to take advantage of the depressed economic condition due to the hurricane. They also paid higher salaries than were average in New Orleans before. The jobs in these new companies were largely filled by more affluent and White people who moved to New Orleans from other areas.

The historically poor and African American neighborhoods did not benefit proportionally from this rapid economic investment as “recovery efforts were concentrated in areas of businesses and wealthier, white neighborhoods.”[17] They continued to live in marginalized conditions of below average incomes within a city that a Housing Authority of New Orleans report showed became more segregated post-Katrina. To make matters worse, the severe housing burden, in which over 50% of monthly income goes to housing, grew from 24% to 38% in Orleans Parish from 2000 to 2017 making cost of living higher as gentrification grew.

Participation in the benefits of the recovery and economic investment was unequal when looking at African American income over time. From 1999 to 2013 Whites in New Orleans grew the proportion in the highest quintile of national income from 25% to 30%. African Americans experienced little change in income and remained at rates well below Whites in the city.

Who Economic Development Helps

From Post-Katrina New Orleans to Post-Amazon NYC as context, and across the variety of programs economic developers have available to enable externally or internally driven economic development, it leads to the questions that economic developers must ask ourselves:

- Who do we create economic development for?

- Is the economic development we create inclusive of everyone in the community?

- Will the most marginalized people in your community be empowered to benefit from economic investment by being able to stay in the community long-term?

- How many local residents will be displaced and damaged through policies that do not consider those in greatest need of economic development?

How we answer these questions and if we include the most marginalized members of our current community will impact the type of economic development we enable and the way in which it will be embraced or resisted by the members of the communities we serve.

Footnotes:

[1] “Community Powered Strategies to Fight Displacement: Lessons from the All-In Cities Anti-Displacement Policy Network,” April 17, 2019, People Places 2019 Conference. Session organized by PolicyLink.

[2] Another way people are addressing the cost of living issue is moving out to more affordable metro areas to become “super commuters” taking 90 minute or more one-way trips to their jobs in high-cost metro areas. Super commuters are one of the fastest growing segments of commuters. An example of this is described in the CNBC article “This 30-year-old commutes 4 hours, and 140 miles, every day so he doesn’t have to pay $4,500-a-month San Francisco rent,” by Shawn Carter. August 20, 2018.

[3] Other large metros with strong GDP ranked by rate of growth include Austin, San Antonio, Charleston, Nashville, Dallas, Pittsburgh, Denver, Charlotte, Phoenix, and others.

[4] People’s Right to Their Places session at People Places 2019.

[5] Ms. Begum also emphasized that organizations must be creative in the approaches used to fight these types of projects.

[6] “Amazon Pulls Out of Planned New York City Headquarters,”By J. David Goodman, New York Times, Feb. 14, 2019

[7] Rima Begum, Community Organizer, Chhaya CDC, during a speech at People Places 2019.

[8] As is discussed later in this article, New Orleans increased incomes for some population segments but it was not an increase for all.

[9] This occurs many ways including remodeling costs being passed onto residents resulting in permanent price increases, restructuring rental agreements enabling landlords to significantly increase rents in the future as the area improves, or simple evictions to make room for higher income residents attracted to the improved neighborhood.

[10] To serve local residents and businesses also requires economic developers to meet with them where they are, because they are not at traditional conferences and places that are a focus of external economic development. They don’t go to conferences like Corenet, BIO, MIPIM, Hanover Messe or other large conferences that economic developers attend to attract outside investment. They also may not be graduating from the elite universities EDOs send staff for talent attraction missions. Instead, you’ll find these people eating at your local restaurants, learning in your libraries, playing at parks, and shopping at your neighborhood businesses. Although it’s also possible you may not see them around town because they may be too busy working multiple jobs just to pay the rent and put food on the table for their family.

[11] Talent Attraction is an economic development initiative to market a location to talented, educated, and skilled workers to grow the local economy.

[12] There is theoretical precedent for this type of policy of taxing job loss. Bill Gates suggests taxing the loss of jobs from automation and robotics.

[13] Read more at Behind the Numbers: The State of Women-Owned Businesses in 2018

[14] “Building Community Wealth through Small Businesses” a session organized by National Coalition for Asian Pacific American Community Development. April 15, 2019. Speakers included Richard Cisneros, Klassi Duncan, Jessie Lee, and Dafina Williams.

[15] For more information about the impact of women owned businesses see the 2018 State of Women-Owned Business Report by American Express and SCORE’s Megaphone of Main Street: Women’s Entrepreneurship, Spring 2018.

[16] Kauffman Foundation. A summary of some of these finding is available at “Study Shows Immigrants are Twice as Likely to Become Entrepreneurs,” Inc. magazine.

[17] “Pushed Out: The Changing Demographics of New Orleans” by Jenn Bentley. Big Easy Magazine. February 2019.